- Home

- Investing

- Stocks

United Parcel Service stock has been a massive long-term laggard.

By

Dan Burrows

published

21 January 2026

in Features

By

Dan Burrows

published

21 January 2026

in Features

When you purchase through links on our site, we may earn an affiliate commission. Here’s how it works.

(Image credit: Mike Kemp/In Pictures via Getty Images)

Share

Share by:

(Image credit: Mike Kemp/In Pictures via Getty Images)

Share

Share by:

- Copy link

- X

As a multinational logistics giant, United Parcel Service (UPS) is seen as something of a bellwether for the economy. Sadly for shareholders, UPS stock has grown only about as fast as the global economy for decades.

Partly that's a function of UPS being a capital-intensive business. Operating a fleet of more than 500 planes and 100,000 vehicles, alongside a highly unionized workforce, means UPS is tethered to "old economy" margins. Meanwhile, the market over the past 20 years has favored "capital-light" tech giants with fat margins over value names that pay hefty dividends.

However, a general market preference for growth stocks isn't the only thing weighing on UPS. Much of the company's sluggishness can be blamed on its former best friend: Amazon.com (AMZN). Once UPS's biggest customer, Amazon is now its most formidable competitor.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

CLICK FOR FREE ISSUE

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Sign upThe pressure Amazon put on margins became so acute that UPS management began a strategic "decoupling," aiming to cut its Amazon-related volume by half by the end of 2026.

While concentrating on higher-margin operations makes strategic sense, forgoing Amazon's massive volume has created a significant "growth gap" that the top line reflects. Indeed, revenue has increased at an average annual rate of less than 5% over the past 20 years. Operating income declined in 10 of the past 20 fiscal years. Those sorts of results don't usually drive outstanding returns.

Track all markets on TradingViewIf there is a bright spot, it's that UPS has been good for the income crowd. The company has raised its dividend annually for 17 years and routinely ranks among the highest-yielding dividend stocks in the S&P 500.

Even better, UPS has increased its payout at a compound annual growth rate of more than 8% over the past two decades. Furthermore, under its current authorization, the company is expected to spend roughly $1 billion in 2026 buying back its own stock.

Analysts are increasingly bullish on UPS stock's prospects going forward. Sorry to say, but long-time shareholders are still sitting on dismal returns.

The bottom line on UPS stock?

UPS has been painful for anyone tough enough to ride it out. Over its entire life as a publicly traded company, UPS stock generated an annualized total return (price change plus dividends) of just 4.6%. (Interestingly, the global economy grew at a similar pace.)

Other standardized time frames are likewise a downer. UPS has a negative total return over the past one-, three- and five-year periods. And it lags the broader market by wide margins over the past 10 and 15 years.

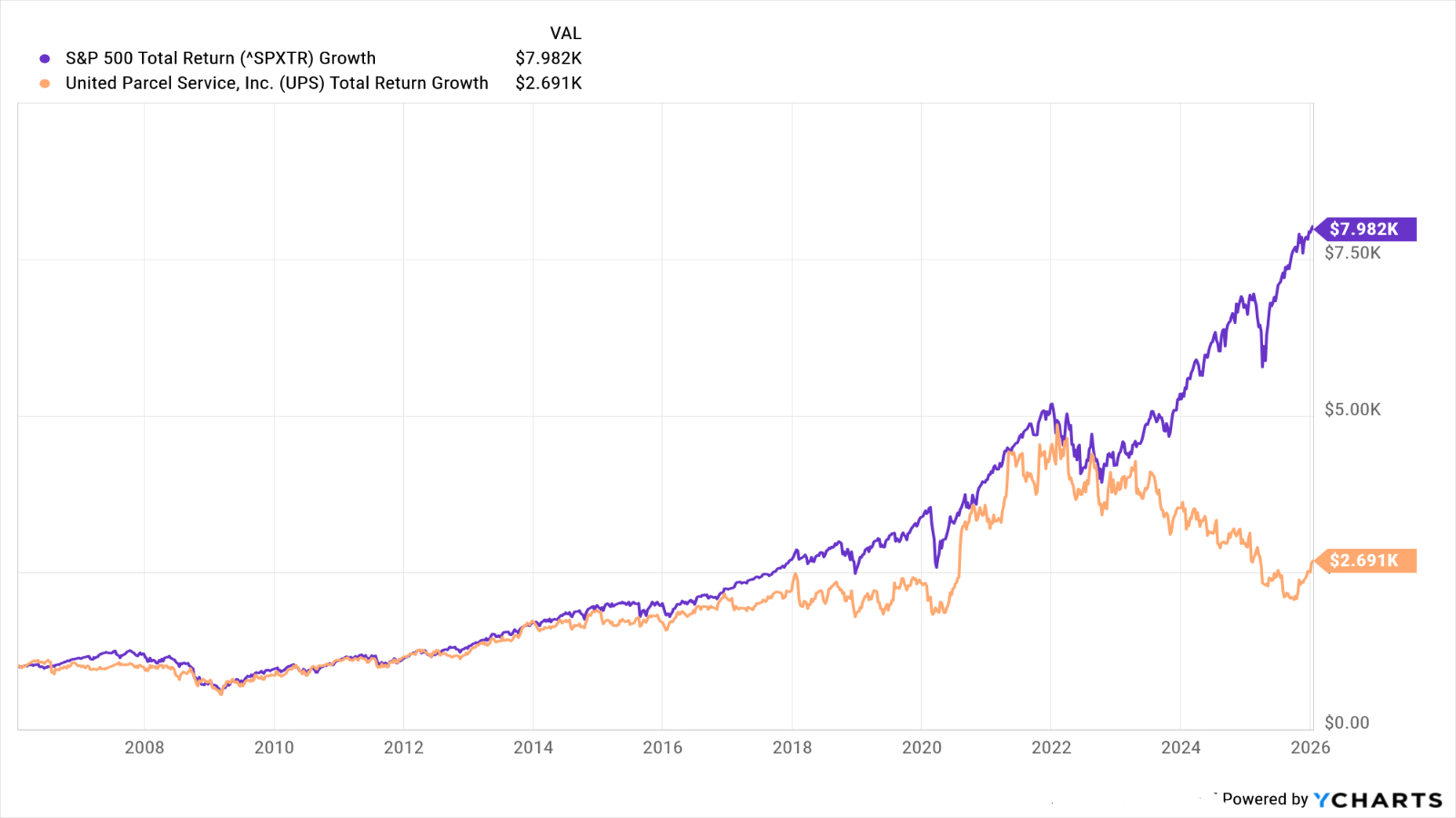

Which brings us to what $1,000 invested in UPS 20 years ago would be worth today. Have a look at the below chart.

A thousand bucks invested in UPS two decades ago would today be worth just $2,700. That's good for an annualized return of 5.2%. The same sum invested in the S&P 500 would theoretically be worth almost $8,000, or a return of 10.9%.

If there's any solace to be found, Wall Street is incrementally more optimistic on the industrial stock – at least over the next 12 months or so. Of the 30 analysts covering UPS surveyed by S&P Global Market Intelligence, 12 rate it at Strong Buy, one says Buy, 14 have it at Hold, two say Sell and one calls it a Strong Sell. That works out to a consensus recommendation of Buy, albeit without much conviction.

Speaking for analysts sitting on the sidelines, Susquehanna's Bascome Majors cites inflation and other macro risks for rating shares at Neutral (the equivalent of Hold).

"Near-term, we believe parcel demand is solid, and investor concern around the well-telegraphed second phase of Amazon's 'glide down' drives a fairly benign setup for UPS," Majors writes. "Mid-term, rising U.S. union labor inflation in 2027 to 2028 keeps us from getting too excited about the fourth quarter of 2026 and beyond."

More Stocks of the Past 20 Years

- If You'd Put $1,000 Into Netflix Stock 20 Years Ago, Here's What You'd Have Today

- If You'd Put $1,000 Into Microsoft Stock 20 Years Ago, Here's What You'd Have Today

- If You'd Put $1,000 Into Apple Stock 20 Years Ago, Here's What You'd Have Today

Dan BurrowsSocial Links NavigationSenior Investing Writer, Kiplinger.com

Dan BurrowsSocial Links NavigationSenior Investing Writer, Kiplinger.comDan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

Latest You might also like View More \25b8

$100,000 Travel Emergencies You Don’t See Coming and How to Prepare

$100,000 Travel Emergencies You Don’t See Coming and How to Prepare

Ask the Tax Editor: Residential Rental Property Questions

Ask the Tax Editor: Residential Rental Property Questions

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7

Why ETFs Are One of the Easiest Ways to Start Investing

Why ETFs Are One of the Easiest Ways to Start Investing

High-Income But Low Confidence? This 5-Point Plan From a Financial Planner Can Fix That

High-Income But Low Confidence? This 5-Point Plan From a Financial Planner Can Fix That

Your Post-Accident Survival Guide, From an Insurance Expert

Your Post-Accident Survival Guide, From an Insurance Expert

3 Investment Lessons From 2025 to Help You Ride Out Any Storm in 2026

3 Investment Lessons From 2025 to Help You Ride Out Any Storm in 2026

Nasdaq Adds 211 Points as Greenland Tensions Ease: Stock Market Today

Nasdaq Adds 211 Points as Greenland Tensions Ease: Stock Market Today

Should You Be Investing in Emerging Markets?

Should You Be Investing in Emerging Markets?

Are You and Your Financial Adviser in Sync on Social Security?

Are You and Your Financial Adviser in Sync on Social Security?